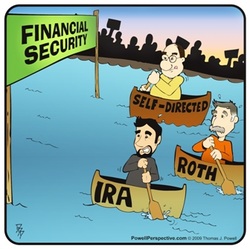

"Overcoming retirement days is a very hard work to overcome." Indeed, it is very tough to prevail over this phenomenon every person will undergo right after their working days are over. However, you should not worry since there is an answer to this problem, the self-directed IRAway. These IRAs is an exceptional way to build your wealth through retirement.

Almost all assets but two can be invested 100% sure with the IRA under the policy of the IRC (Internal Revenue Code)-collectibles and life insurances. Some of these assets include real estate, gold, tax liens, small franchises and businesses and mortgages. It is not limited to the list given as there are many more assets you can use. Even though you can use any assets, you must comply with the rules and regulations set by the IRC. The only thing that you should avoid executing is the "prohibited transactions". There are many cases of prohibited transactions due to improper management of retirement plan and the so called "disqualified party".

- The IRA account owner and the owner's spouse

- The account owner's lineal ascendants and descendant

- Your parents and grandparents

- Your spouse's parents and grandparents

- The corporation or the custodian where you have entrusted your investments

- A highly salaried employee of a certain unit or any person that owns a 10% part of a company

- This disqualified party extends to spouse's of your children-daughter-in-law or son-in-law

- Your IRA's investment manager

Your self-directed IRA, just like any other retirement plan, tends to help the account owner's retirement during their retirement days. The self-directed IRA provides rule that will prevent any activity that is not connected in any form to the retirement plan signed. Self-directed IRAs are prohibited directly or indirectly to sell, lease or exchange any property from the IRAs to the account owner or among the disqualified party. Below are the common prohibited transactions (as there are many more prohibited transactions):

- Living in the house your retirement plan have purchased

- Using the assets you invested in the IRA as a loan collateral

- Lending money to your spouse or children

- Using the IRA's investment to pay fees

- Purchasing gems or any kind of collectibles by virtue of your retirement funds Buying life insurances

These are the common errors an account owner usually makes. You are at risk of the prohibited transaction if you have done one of the prohibited acts. Every investors and account owners should make a decision of whether he should take the risk for the pending reward he might get or not. However, if the investor does have an ill feeling about the risk, then he should avoid that unusual transactions and just follow the self-directed IRA way.